Ledger Accounts Definition, Format, Types, & Advantages

Modern businesses and companies need a lot of record keeping to run their operations. The features, reliability, and security provided by DLT are unmatched. DLT can solve many problems in keeping records nowadays and help make business processes more efficient. By altering some of the principles of how businesses gather and exchange the data that goes into their ledgers, distributed ledger technology may significantly enhance record-keeping. DLT is a digital method for documenting asset transactions in which the transactions and their information are stored in several locations simultaneously.

- Let us discuss the definition and types of ledger accounts with the help of an example.

- Summarize the ending balances from the general ledger and present account level totals to create your trial balance report.

- Any increase in liability is recorded on the credit side of the account, while any decrease is recorded on the debit side.

- Sum of all the money owed to a business by their customers is shown here and is termed as Accounts Receivable, Trade Debtors or Sundry Debtors.

The trial balance then checks whether the transactions are accurate or not and adjusted accordingly. Later, the data summarized in the trial balance is used for creating financial statements such as the income statement, balance sheet, and cash flow statement. A general ledger is the main type of ledger that is usually used by companies.

What is a General Ledger Accounting?

There are some rules that students should understand according to the nature of debit and credit. Purchase Ledger – Purchase Ledger is a ledger in which the company organizes the transaction of purchasing the services, products, or goods from other businesses. It gives the visibility of how much amount the company paid to other businesses. A purchase ledger is used to keep track of all the purchases made by a business. This may include parts, supplies, equipment, and inventory for their products.

The company’s bookkeeper records transactions throughout the year by posting debits and credits to these accounts. The transactions result from normal business activities such as billing customers or purchasing inventory. They can also result from journal entries, such as recording depreciation. Preparing a ledger is important as it serves as a master document for all your financial transactions.

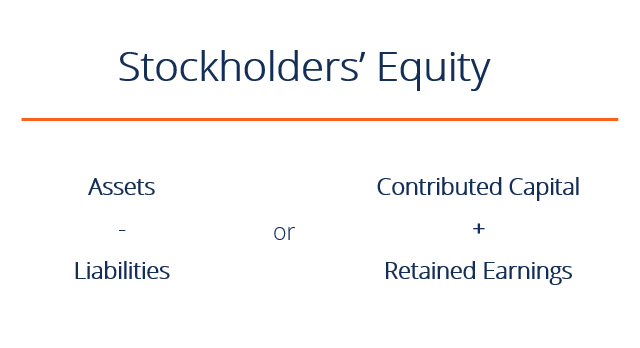

Equity:

The trial balance totals are matched and used to compile financial statements. There are some rules which you have to adhere to while writing the journal entries for the following accounts. Also, in ledger accounts, this specimen is used for writing the entries of the accounting. Any increase in capital is also recorded on the credit side, and any decrease is recorded on the debit side of the respective capital account. Banks and other financial institutions are examples of business organizations that use self-balancing ledger accounts. All entries recorded in the general journal must be transferred to ledger accounts.

Another important fact to note stems from the fact that total assets are equal to total liabilities and capital at any given time. If he draws any money or goods from the business, this will reduce his capital, accounting for amazon fba sellers amazon bookkeeping meaning that an entry should be made on the debit side of his capital account. Any increase in liability is recorded on the credit side of the account, while any decrease is recorded on the debit side.

What is the purpose of an accounting ledger?

The following example is useful to clarify the posting and balancing procedure. To elaborate on the third point above, this difference so placed is the balance of the account. The title of the account is written in the center at the top of the page.

The purchase ledger, also called a creditor’s ledger, contains the accounting records related to purchases made by the business on credit. In other words, if the business has bought goods from sellers on credit, the details of those transactions will be entered in this ledger. A ledger is integral to business accounting and helps you keep track of business finances. If you own a business, it’s important to understand the basics of maintaining accounts for business transactions. These basics are especially relevant if you’re doing accounting and book-keeping. They are also relevant to you if you’re involved in running a business or handling the affairs and transactions of a business, or doing anything that requires you to understand accounting.

Is it mandatory for businesses to prepare an accounting ledger?

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Understanding Distributed Ledger Technology

To better understand the purpose of accounting ledgers, it’s helpful to understand how they differ from journals. An accounting journal, also called the book of original entry, is where financial transactions are first recorded. The details are then summarised into a T format within the accounting ledger book. A T-shaped ledger entry allows you to show debits on one side, and credits on the other. The details move on from the ledger to create a trial balance, and finally show up on the balance sheet and income statement. The ledger meaning in accounting refers to a book where businesses record all the information needed to prepare financial statements.

Liabilities

However, if the account is large, it may extend to two or more pages. Once you have calculated the operating profit, you need to subtract depreciation and amortization, interest payment, and tax. If all other sites open fine, then please contact the administrator of this website with the following information.