How to Prepare a Statement of Retained Earnings: A Step-by-Step Guide with Example

Over time, retained earnings can have a significant impact on a company’s growth and profitability. Subtract the dividends, if paid, and then calculate a total for the statement of retained earnings. This is the amount of retained earnings that is posted to the retained earnings account on the 2020 balance sheet. On the other hand, investors should look at more than just high retained earnings when looking for a high-growth investment. An overleveraged company may avoid paying dividends, but that doesn’t make the company a high-growth asset for the investor.

Income Statement and Cash Flow Statement Interdependence

Understanding this interdependence is crucial for accurate financial analysis and forecasting. Here’s a breakdown of the interconnections and how they impact financial analysis. Assuming your business pays its shareholders dividends (stock or cash), you’ll need to factor those into your calculations. Subtract the amount paid in dividends in the revolving funds for financing water and wastewater projects current accounting period from your retained earnings balance from that same period. The retention ratio helps investors determine how much money a company is keeping to reinvest in the company’s operation. If a company pays all of its retained earnings out as dividends or does not reinvest back into the business, earnings growth might suffer.

FAQs About Retained Earnings Calculation

It’s the tangible evidence of Widget Inc.’s past prudence and a promissory note for its assertive strides into future markets. The plot behind this step revolves around the outcome of your business’s operations. Revenue is nothing but a high-five until you subtract the costs it took to rack up those sales. Retained earnings are a business’s remaining earnings after paying all of its direct and indirect expenses, income taxes, and dividends to shareholders. The equity stake in the company can be used, for example, to fund marketing, R&D, and new machinery purchases. We must remember that statement of income and retained earnings example help us gauge the net income left with a company after dividends (cash/stock) are paid to the shareholders.

You’re our first priority.Every time.

They shed light on the internal reinvestment strategy and payout policies, allowing investors to discern how their capital is being utilized for fostering growth. By effectively communicating the strategy behind retained earnings, the company fosters transparency and trust. This isn’t just accounting; it’s strategic communication that reinforces shareholder confidence and underscores the company’s potential. By comprehending the choreography between beginning balance, net income, and dividends, you’ve gleaned how a statement of retained earnings is not just interpreted but also orchestrated. It’s the dance of digits that ultimately reveals the health and direction of a business. This number isn’t just another entry on the books; it’s the measure of your company’s accumulated wealth over time that hasn’t been dished out to shareholders.

Calculate and Subtract Dividends Paid to Shareholders in Current Period

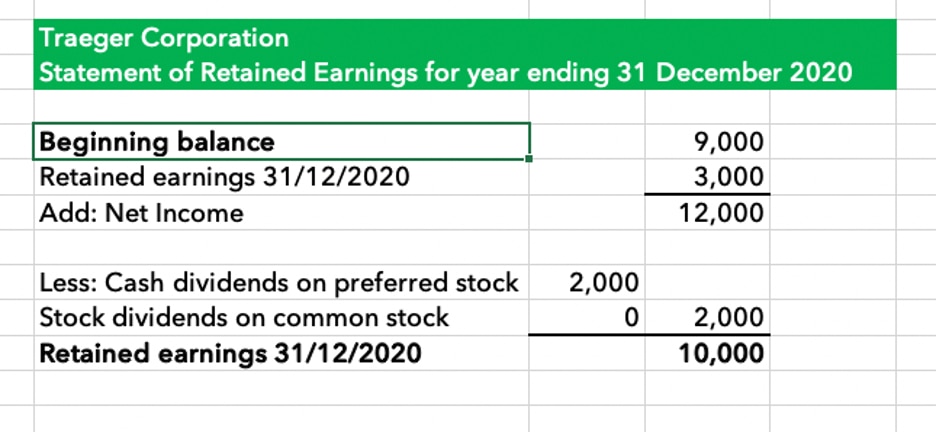

Because RE is calculated to date, they accumulate from one period to the next. This means that in order to calculate RE for the current accounting period, you’ll need to know your ending balance from the prior period. This ending balance is found in the stockholders’ equity section of the balance sheet as of the end of the prior accounting period. Retained earnings are calculated by subtracting a company’s total dividends paid to shareholders from its net income. This gives you the amount of profits that have been reinvested back into the business. A statement of retained earnings shows the changes in a business’ equity accounts over time.

- Building an integrated model requires a structured approach, linking each financial statement and incorporating assumptions to ensure consistency and accuracy.

- Once you’ve settled on the starting line with the beginning balance, you’re ready to turn up the heat with the core element of retained earnings – your net income (or sometimes, alas, the net loss).

- The statement of retained earnings is a financial statement that is prepared to reconcile the beginning and ending retained earnings balances.

- This statement can signal either growth potential or a warning bell of upcoming financial troubles, making it a crucial document for investors, shareholders, and directors alike.

- Within a company, these numbers illustrate management’s prowess in using profits effectively and deciding on dividend distributions.

What is your current financial priority?

Investors need to look at the company’s balance sheet to see the big picture. A financial model can facilitate scenario analysis to evaluate the impact of capital expenditures on a company’s financial health. For example, if a company is considering purchasing new equipment, the model can simulate different scenarios, such as varying costs, financing options, and expected returns. This analysis aids in determining whether the investment is financially viable and aligns with the company’s strategic goals. You can also move the money to cash flow to pay for some form of extra growth.

Investors want to see an increasing number of dividends or a rising share price. Although they’re shareholders, they’re a few steps removed from the business. A retained earnings statement is one concrete way to determine if they’re getting their return on investment. By comparing retained earnings balances over time, investors can better predict future dividend payments and improvements to share price. Financial statements—namely, the income statement, balance sheet, and cash flow statement—are closely interconnected. Each statement influences and depends on the others, providing a holistic view of a company’s financial health.

Ensure you have a three-line header on a statement of retained earnings. They increase with a credit entry, and retained earnings decrease with a debit entry. Unappropriated earnings—as you may have guessed—are the amount of earnings not appropriated at the end of a given period. These earnings are typically also used for growth, but they’re not earmarked for a specific transaction or project. A company’s board of directors may decide to appropriate earnings for various purposes, including acquisition, stock buyback, research and development, and debt reduction.