Debt-to-equity ratio Wikipedia

For someone comparing companies in these two industries, it would be impossible to tell which company makes better investment sense by simply looking at both of their debt to equity ratios. A company’s debt to equity ratio can also be used to gauge the financial risk of the company. While this limits the amount of liability the company is exposed to, low debt to equity ratio can also limit the company’s growth and expansion, because the company is not leveraging its assets. A D/E ratio close to zero can also be a negative sign as it indicates that the business isn’t taking advantage of the potential growth it can gain from borrowing.

Is a Higher or Lower Debt-to-Equity Ratio Better?

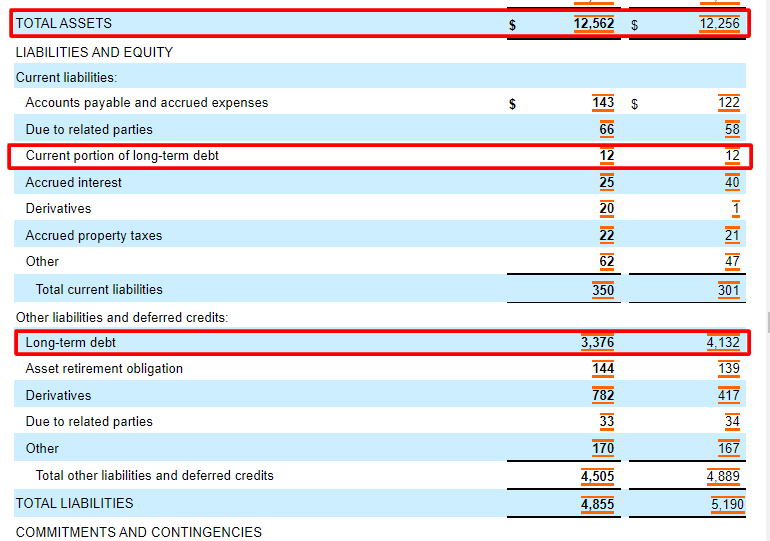

For example, utility companies have highly reliable sources of revenue because they provide a necessary commodity and often have limited competition. This allows companies to take on greater debt without taking on greater risk. For the remainder of the forecast, the short-term debt will grow by $2m each year, while the long-term debt will grow by $5m.

Debt to Equity Ratio Formula & Example

- A company with a high ratio is taking on more risk for potentially higher rewards.

- It’s not just about numbers; it’s about understanding the story behind those numbers.

- A lower D/E ratio isn’t necessarily a positive sign 一 it means a company relies on equity financing, which is more expensive than debt financing.

- In most cases, a low debt to equity ratio signifies a company with a significantly low risk of bankruptcy, which is a good sign to investors.

- Debt financing is often seen as less risky than equity financing because the company does not have to give up any ownership stake.

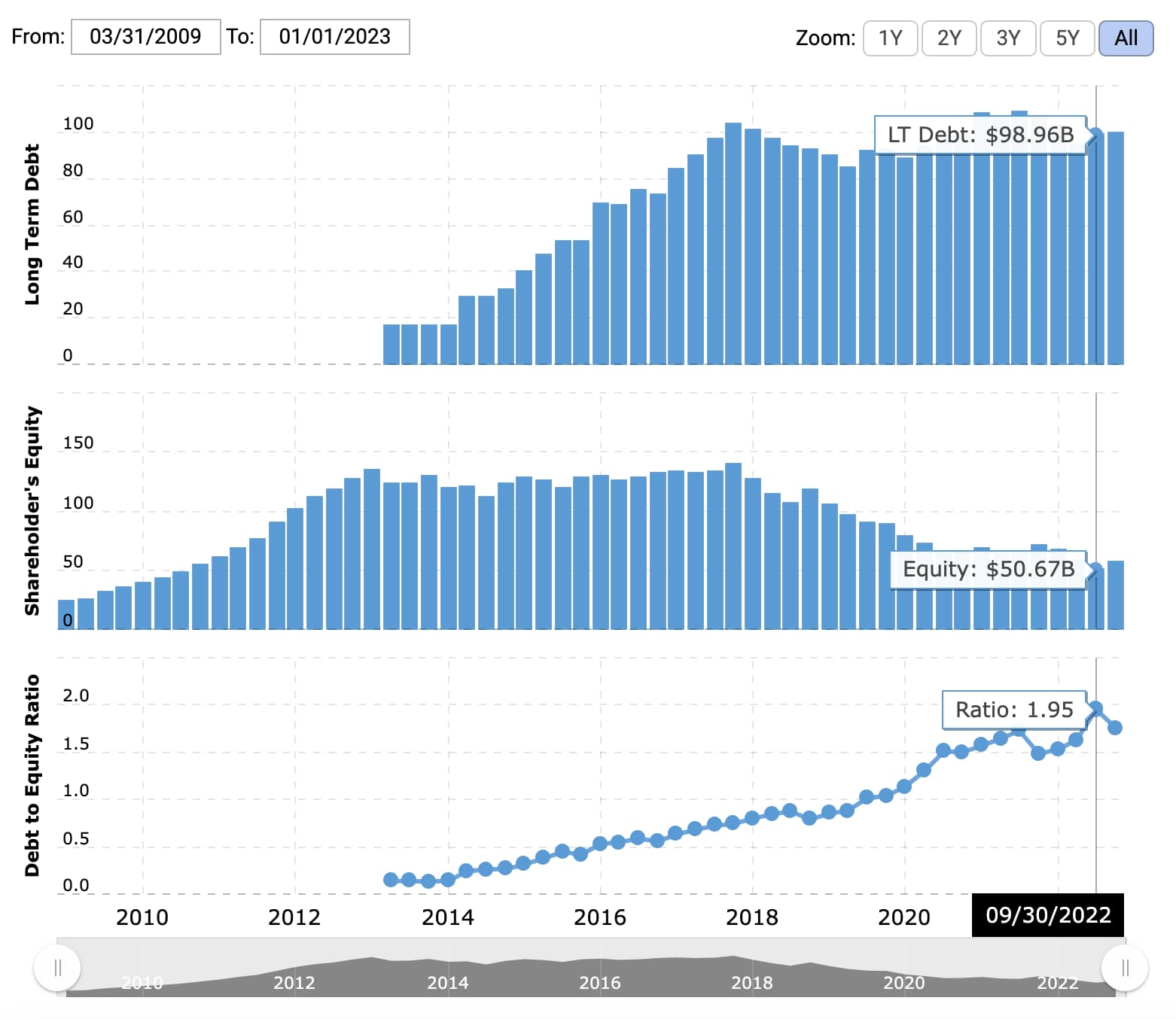

Conversely, if the D/E ratio is too low, managers may issue more debt or repurchase equity to increase the ratio. Managers can use the D/E ratio to monitor a company’s capital structure and make sure it is in line with the optimal mix. This could lead to financial difficulties if the company’s earnings start to decline especially because it has less equity to cushion the blow. retail accounting basics Overall, the D/E ratio provides insights highly useful to investors, but it’s important to look at the full picture when considering investment opportunities. Banks also tend to have a lot of fixed assets in the form of nationwide branch locations. Airlines, as well as oil and gas refinement companies, are also capital-intensive and also usually have high D/E ratios.

Why Is Debt-to-Equity Ratio Important?

An increase in the D/E ratio can be a sign that a company is taking on too much debt and may not be able to generate enough cash flow to cover its obligations. However, industries may have an increase in the D/E ratio due to the nature of their business. For example, capital-intensive companies such as utilities and manufacturers tend to have higher D/E ratios than other companies. The concept of a “good” D/E ratio is subjective and can vary significantly from one industry to another. Industries that are capital-intensive, such as utilities and manufacturing, often have higher average ratios due to the nature of their operations and the substantial amount of capital required. Therefore, it is essential to align the ratio with the industry averages and the company’s financial strategy.

As a general rule of thumb, a good debt-to-equity ratio will equal about 1.0. However, the acceptable rate can vary by industry, and may depend on the overall economy. A higher debt-to-income ratio could be more risky in an economic downturn, for example, than during a boom. The company can use the funds they borrow to buy equipment, inventory, or other assets — or to fund new projects or acquisitions. The money can also serve as working capital in cyclical businesses during the periods when cash flow is low. The debt-to-equity ratio (D/E) is one of many financial metrics that helps investors determine potential risks when looking to invest in certain stocks.

Newell Brands, the maker of Sharpies and Rubbermaid containers, refinanced $1.1 billion in bonds in September 2022, agreeing to an interest rate of 6.4–6.6%. This is a significant jump from the 3.9% rate the company had previously been paying. So, the debt-to-equity ratio of 2.0x indicates that our hypothetical company is financed with $2.00 of debt for each $1.00 of equity. Gearing ratios focus more heavily on the concept of leverage than other ratios used in accounting or investment analysis. The underlying principle generally assumes that some leverage is good, but that too much places an organization at risk. The company must also hire and train employees in an industry with exceptionally high employee turnover, adhere to food safety regulations for its more than 18,253 stores in 2022.

Whereas, equity financing would entail the issuance of new shares to raise capital which dilutes the ownership stake of existing shareholders. Yes, the ratio doesn’t consider the quality of debt or equity, such as interest rates or equity dilution terms. The D/E ratio indicates how reliant a company is on debt to finance its operations. They do so because they consider this kind of debt to be riskier than short-term debt, which must be repaid in one year or less and is often less expensive than long-term debt.

It’s great to compare debt ratios across companies; however, capital intensity and debt needs vary widely across sectors. The financial health of a firm may not be accurately represented by comparing debt ratios across industries. Bear in mind how certain industries may necessitate higher debt ratios due to the initial investment needed. Last, businesses in the same industry can be contrasted using their debt ratios.

When interpreting the D/E ratio, you always need to put it in context by examining the ratios of competitors and assessing a company’s cash flow trends. However, if that cash flow were to falter, Restoration Hardware may struggle to pay its debt. Ultimately, businesses must strike an appropriate balance within their industry between financing with debt and financing with equity. To get a clearer picture and facilitate comparisons, analysts and investors will often modify the D/E ratio. They also assess the D/E ratio in the context of short-term leverage ratios, profitability, and growth expectations.

Debt to equity ratio is the most commonly used ratio for measuring financial leverage. Other ratios used for measuring financial leverage include interest coverage ratio, debt to assets ratio, debt to EBITDA ratio, and debt to capital ratio. However, what is actually a “good” debt-to-equity ratio varies by industry, as some industries (like the finance industry) borrow large amounts of money as standard practice. On the other hand, businesses with D/E ratios too close to zero are also seen as not leveraging growth potential. Investors typically look at a company’s balance sheet to understand the capital structure of a business and assess the risk.

The debt-to-equity ratio (D/E) is calculated by dividing the total debt balance by the total equity balance. In the majority of cases, a negative D/E ratio is considered a risky sign, and the company might be at risk of bankruptcy. However, it could also mean the company issued shareholders significant dividends. Lenders and debt investors prefer lower D/E ratios as that implies there is less reliance on debt financing to fund operations – i.e. working capital requirements such as the purchase of inventory.