Debt-to-Equity D E Ratio: Meaning and Formula

What counts as a “good” debt-to-equity (D/E) ratio will depend on the nature of the business and its industry. Generally speaking, a D/E ratio below 1 would be seen as relatively safe, whereas values of 2 or higher might be considered risky. Companies in some industries, such as utilities, consumer staples, and banking, typically have relatively high D/E ratios. Business owners use a variety of software to track D/E ratios and other financial metrics. Microsoft Excel provides a balance sheet template that automatically calculates financial ratios such as the D/E ratio and the debt ratio. If a company’s debt to equity ratio is 1.5, this means that for every $1 of equity, the company has $1.50 of debt.

Is an increase in the debt-to-equity ratio bad?

For example, if a company, such as a manufacturer, requires a lot of capital to operate, it may need to take on a lot of debt to finance its operations. The company can use the funds they borrow to buy equipment, inventory, or other assets — or to fund new projects or acquisitions. The money can also serve as working capital in cyclical businesses during the periods when cash flow is low.

- However, if the company were to use debt financing, it could take out a loan for $1,000 at an interest rate of 5%.

- All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

- For instance, if Company A has $50,000 in cash and $70,000 in short-term debt, which means that the company is not well placed to settle its debts.

Subscribe to Kiplinger’s Personal Finance

For example, capital-intensive companies such as utilities and manufacturers tend to have higher D/E ratios than other companies. The debt-to-equity ratio is one of the most important financial ratios that companies use to assess their financial health. It provides insights into a company’s leverage, which is the amount of debt a company has relative to its equity. The current ratio reveals how a company can maximize its current assets on the balance sheet to satisfy its current debts and other financial obligations.

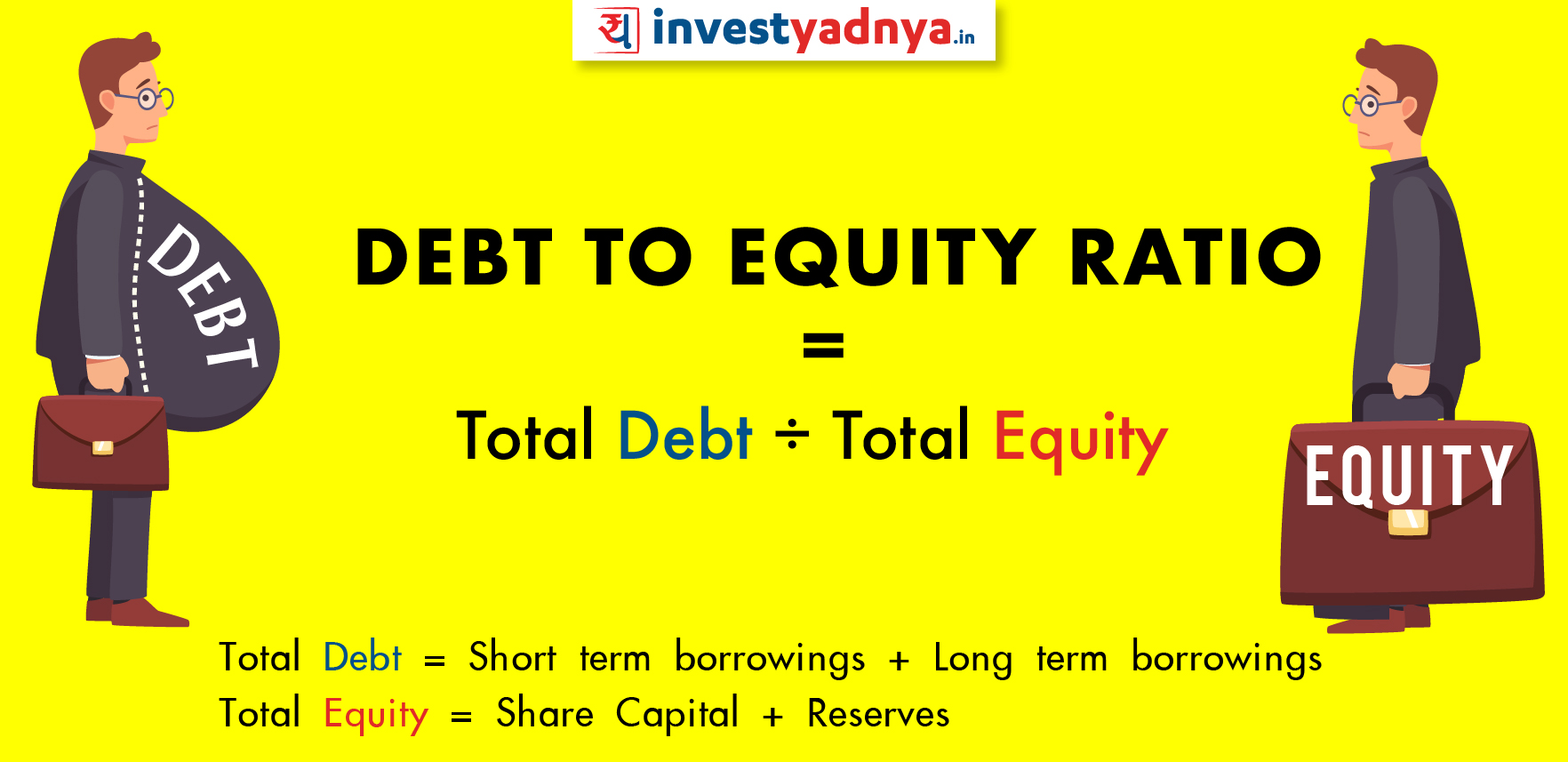

Debt-to-Equity (D/E) Ratio Formula and How to Interpret It

This allows businesses to fund expansion projects more quickly than might otherwise be possible, theoretically increasing profits at an accelerated rate. This debt to equity calculator helps you to calculate the debt-to-equity ratio, otherwise known as the D/E ratio. This metric weighs the overall debt against the stockholders’ equity and indicates the level of risk in financing your company. When evaluating a company’s debt-to-equity (D/E) ratio, it’s crucial to take into account the industry in which the company operates. Different industries have varying capital requirements and growth patterns, meaning that a D/E ratio that is typical in one sector might be alarming in another. Capital-intensive sectors, such as utilities and manufacturing, often have higher ratios due to the need for significant upfront investment.

Personal Loans

The depository industry (banks and lenders) may have high debt-to-equity ratios. Because banks borrow funds to loan money to consumers, financial institutions usually have higher debt-to-equity ratios than other industries. The debt-to-equity ratio (D/E) is one of many financial metrics that helps investors determine potential risks when looking to invest in certain stocks. A steadily rising D/E ratio may make it harder for a company to obtain financing in the future. The growing reliance on debt could eventually lead to difficulties in servicing the company’s current loan obligations. Very high D/E ratios may eventually result in a loan default or bankruptcy.

This figure means that for every dollar in equity, Restoration Hardware has $3.73 in debt. The following D/E ratio calculation is for Restoration Hardware (RH) and is based on its 10-K filing for the financial year ending on January 29, 2022. Determining whether a company’s ratio is good or bad means considering other factors in conjunction with the ratio. Of note, there is no “ideal” D/E ratio, though investors generally like it to be below about 2. In addition, the reluctance to raise debt can cause the company to miss out on growth opportunities to fund expansion plans, as well as not benefit from the “tax shield” from interest expense.

A company with a higher ratio than its industry average, therefore, may have difficulty securing additional funding from either source. While taking on debt can lead to higher returns in the short term, it also increases the company’s financial risk. This is because the company must pay back the debt regardless of its financial performance. If the company fails to generate enough revenue to cover its debt obligations, it could lead to financial distress or even bankruptcy.

Investors can compare a company’s D/E ratio with the average for its industry and those of competitors to gain a sense of a company’s reliance on debt. Including preferred stock in total debt will increase the D/E ratio and make a company look riskier. Including preferred stock in the equity portion of the D/E ratio will increase the denominator and lower the ratio.

The energy industry, for example, only recently shifted to a lower debt structure, Graham says. You could also replace the book equity found on the balance sheet with the market value of the company’s equity, called enterprise value, in the denominator, he says. “The book value is beholden to many accounting principles that might not reflect the company’s actual value.” The interest paid on debt also is typically tax-deductible for the company, while equity capital is not. In summary, computing the Debt to Equity ratio is essential for assessing financial health and risk.

In contrast, industries like technology or services, which require less capital, tend to have lower D/E ratios. Generally, a ratio below 1 is considered safer, while a ratio above 2 might indicate higher financial risk. The current ratio measures the capacity of a company to pay its short-term obligations in a year or less. Analysts and investors current assets definition lists and formula 2023 compare the current assets of a company to its current liabilities. Taking a broader view of a company and understanding the industry its in and how it operates can help to correctly interpret its D/E ratio. For example, utility companies might be required to use leverage to purchase costly assets to maintain business operations.